Most sporting goods brands believe market dominance comes from celebrity endorsements, aggressive advertising budgets or premium positioning. Decathlon invalidates all three assumptions. Its growth in India and globally has not been fuelled by traditional marketing theatrics or lifestyle-driven campaigns.

Decathlon does not behave like Nike, Adidas or Puma. It does not chase aspirational imagery or sponsor elite athletes. It behaves like a manufacturing company that happens to sell directly to consumers.

This effectiveness is not mysterious. An experienced digital marketing agency would say it is the outcome of strategic decisions about vertical integration, pricing architecture, store design and product philosophy. The Decathlon marketing strategy works because it is inseparable from business operations.

For brands attempting to challenge Decathlon in India’s sporting goods market, the lesson is clear. Surface-level imitation fails. Success requires structural transformation that most organisations cannot afford or sustain.

Table of Contents

- What Actually Is Decathlon?

- Why Competitors Cannot Replicate Decathlon’s Model

- Manufacturing Control as a Marketing Weapon

- The Store Experience No One Can Fake

- Pricing That Kills Competition Quietly

- Product Range as an Unfair Advantage

- Brand Silence That Speaks Louder

- The Staff Secret Competitors Miss

- What Brands Get Wrong About Decathlon

- Conclusion

- FAQs

What Actually Is Decathlon?

Decathlon started in 1976 in Lille, France, with one belief: sports should be accessible to everyone. Not marketing fluff. Operational philosophy.

The India entry happened in 2009 through a cash-and-carry model. By the time FDI regulations changed, Decathlon had already secured supplier relationships and real estate advantages that competitors still chase today.

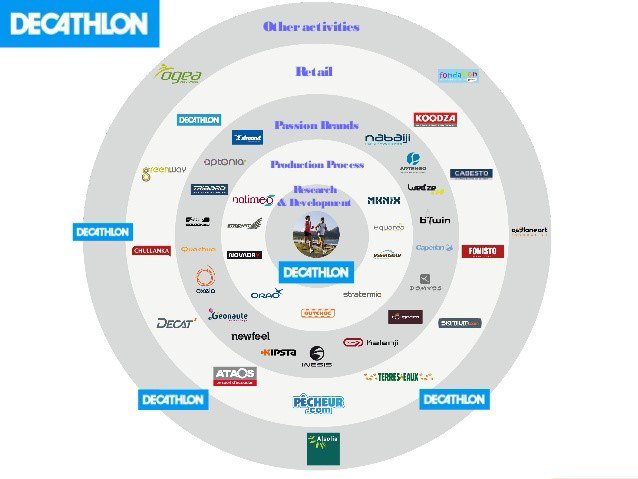

By 2024, over 100 stores operate across India with revenues exceeding ₹3,500 crore. Global revenues crossed €13.8 billion in 2021. The company owns 20+ in-house brands spanning 70+ sports categories. Approximately 85% of Indian inventory is manufactured domestically. (Source: Entrackr)

Why Competitors Cannot Replicate Decathlon’s Model

Traditional retailers treat marketing as a separate function. Decathlon treats marketing as an output of operational decisions. This distinction explains why copying them fails.

A premier branding agency focuses on communication and creative execution. These matter, but they are downstream. Decathlon’s brand strength comes from upstream realities: product availability, consistent quality, and price predictability.

Consider the challenge. To match Decathlon’s pricing, competitors must either:

- Accept lower margins (which requires higher volume).

- Reduce costs (which requires manufacturing control).

Most brands solve this by positioning themselves upmarket or targeting niches. Decathlon does neither. It occupies the mass market across all sports categories simultaneously. This breadth creates network effects that specialised retailers cannot match.

In India specifically, real estate costs, logistics complexity, and talent availability favour entrenched players. New entrants face structural disadvantages that even massive marketing budgets cannot overcome.

Manufacturing Control as a Marketing Weapon

Owning production means controlling quality, design, and availability. These factors drive customer satisfaction more reliably than any advertisement ever could.

In India, Decathlon works with over 500 local suppliers. This network took 15 years to build. These suppliers understand quality standards, pricing constraints, and volume requirements. These relationships cannot be spun up overnight.

Vertical Integration also enables rapid product iteration.

- Scenario: A customer reports a design flaw in a hiking bag.

- Decathlon’s Move: They modify production directly at the factory level.

- Competitor’s Move: They negotiate with a third-party vendor, facing long lead times and contract disputes.

From a digital marketing agency perspective, this creates an unusual dynamic. The product itself becomes the primary marketing asset. Happy customers return and recommend. Dissatisfied customers receive improvements. This loop reduces the dependence on paid acquisition.

The Store Experience No One Can Fake

Decathlon stores average 20,000–30,000 square feet, often located on city outskirts where real estate costs are manageable. This creates a specific trade-off: they sacrifice casual footfall for store economics. The customers who do visit are high-intent; they stay longer and convert at higher rates.

View this post on Instagram

Crucially, product testing is encouraged.

- Bounce basketballs.

- Swing badminton rackets.

- Test treadmills.

- Ride bicycles in the aisles.

This experiential approach reduces purchase hesitation whilst increasing satisfaction.

Store layout reinforces the philosophy. Products are organised by Sport, not by brand or price. A customer looking for cricket equipment finds everything—bats, balls, pads, gloves, in one section. This reduces decision complexity and increases basket size.

The store model requires patience. New locations take 18–24 months to reach profitability. Competitors seeking faster returns cannot justify this investment. This time horizon difference is strategic, not financial.

Pricing That Kills Competition Quietly

Decathlon’s pricing strategy is misunderstood as competing on cost. It competes on value perception. Products are priced 20-30% below comparable alternatives, but they are not positioned as budget options.

View this post on Instagram

This distinction matters psychologically. Customers do not feel they are compromising. They feel they are making rational decisions. This preserves brand equity whilst enabling volume.

The pricing strategy also creates barriers. To compete, brands must either match prices (requiring similar cost structures) or convince customers to pay more (requiring significant brand investment). Both paths are difficult.

In India specifically, this affordability unlocks massive market expansion. Families that previously bought one cricket bat per child can now afford multiple sports equipment items. This behavioural shift grows the overall category, benefiting Decathlon disproportionately.

Product Range as an Unfair Advantage

Decathlon’s catalogue spans over 70 sports with thousands of SKUs. This breadth is prohibitively expensive for competitors to match. Each sport requires product development, supplier relationships, and inventory management.

This range creates multiple advantages:

- Cross-Category Discovery: A parent buying football gear notices swimming equipment.

- Habit Formation: Customers learn that Decathlon likely stocks whatever they need.

- Mental Availability: It reduces search behaviour. Instead of comparing options, customers default to Decathlon first.

In India, this strategy unlocks Tier-2 and Tier-3 cities where specialised sports retailers do not exist. Decathlon becomes the only option for quality equipment at accessible prices

Brand Silence That Speaks Louder

Decathlon’s marketing budget is remarkably small relative to its revenue. The company does not advertise on television, does not sponsor major sporting events (IPL, World Cup), and does not engage expensive celebrity ambassadors.

This absence is strategic.

- Traditional Marketing: Creates Aspiration (“Be like this athlete”).

- Decathlon Marketing: Creates Utility (“Play this sport”).

Customers do not buy Decathlon products to signal identity. They buy them to play sports. This functional positioning reduces marketing dependency. Every rupee not spent on a celebrity endorsement is passed to the customer in lower prices.

An experienced advertising agency might view this as a missed opportunity. In reality, it is disciplined capital allocation. Decathlon grows through word-of-mouth, store expansion, and product satisfaction.

The Staff Secret Competitors Miss

Decathlon prefers to hire sports enthusiasts, often accepting lower retail experience in exchange for genuine passion. This inverts conventional retail logic.

View this post on Instagram

Staff are trained not just on product features but on the sports themselves.

- The cricket section is staffed by cricketers.

- The cycling section is staffed by cyclists.

This depth of knowledge fundamentally changes customer interactions. Advice feels genuine because it is genuine. The paradox is that this approach scales poorly. Each new store requires identifying, hiring, and training enthusiasts in that specific geography. This limits expansion speed but ensures consistency—a trade-off Decathlon is willing to make.

What Brands Get Wrong About Decathlon

Most competitors study Decathlon’s store design, pricing, or product range. They miss the operational integration that makes these elements viable.

- Brands attempting to replicate pricing without manufacturing infrastructure simply erode their margins.

- Those copying store formats without training investments create disappointing experiences.

- Those expanding product ranges without supply chain capabilities face inventory nightmares.

The fundamental misunderstanding is treating Decathlon as a retail innovation when it is actually a manufacturing innovation. A responsible branding agency would advise clients to learn from Decathlon’s operational discipline, not just its surface tactics. The lesson is about aligning business model, customer promise, and operational capability into a coherent system.

Conclusion

Decathlon’s marketing effectiveness stems from structural advantages that competitors cannot replicate without fundamental business model transformation. Vertical integration, manufacturing discipline, store economics, and product range create compounding benefits that resist imitation.

The brand succeeds not through superior messaging but through superior execution. It prioritises operational excellence over creative brilliance, functional utility over aspirational imagery, and long-term customer relationships over short-term acquisition.

If you are ready to stop copying tactics and start building a structural advantage that competitors cannot fake, it is time to consult with a strategic branding agency that helps businesses align their operational reality with their market promise to create brands that are impossible to ignore and impossible to copy.